Even though it feels like summer ourside, you can tell the seasons are changing. The kids are back in school in Encinitas, and we even had a dusting of snow in the Sierras last week. Fall will be here before we know it.

Another change is on the horizon for investors – interest rate cuts. During a conference last week, Jerome Powell indicated that “the time has come for policy to adjust“.

“Inflation has declined significantly. The labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic,” Powell said. “Supply constraints have normalized. And the balance of the risk to our two mandates has changed.”

Fed Chair Powell Indicates Interest Rate Cuts Ahead

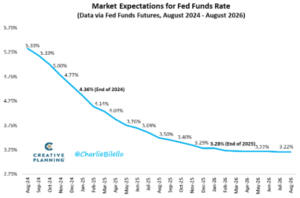

The market has priced in almost a full percentage point rate cut for the remainder of 2024 and another 1% on top of that for 2025.

A potential 2% point drop in interest rates could dramatically change the investment landscape. Before we dig into this, we have to at least mention the market volatility at the beginning of the month. If you just opened your July and August investment statements, you probably didn’t notice a huge change. But two market events happened earlier this month: the 2nd largest drop in history for Japan’s Nikkei index and a spike in volatility (measured by the VIX index) to the third highest in history.

You can read more about what caused the volatility (the carry trade) here if you’d like. Market history is filled with these mini blow ups. But what’s most surprising about this is how quick the recovery was. The S&P 500 dropped almost 10% and is now back within striking distance of an all-time high again.

While it isn’t ideal for a 10% round trip in such a short period of time, it’s good that the market looked past the volatility. The reality is that the economy remains in good shape. Per Apollo:

Looking at the latest daily and weekly data shows that retail sales are strong, jobless claims are falling, restaurant bookings are strong, air travel is strong, hotel occupancy rates are high, bank credit growth is accelerating, bankrupcy filings are trending lower, credit card spending is solid, and Broadway show attendance and box office grosses are strong.

The bottom line is that there are no signs of a recession in the incoming data.

The Economy Is Doing Just Fine

So now that interest rate cuts are coming, and the economy seems to be OK, does that mean we’re in the clear?

Maybe?

What Happens After the First Interest Rate Cut?

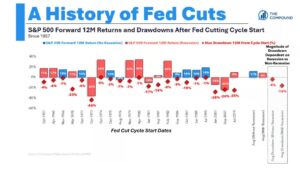

The path of the market is largely dependent on whether the Fed is cutting rates into an impending recession – an unknowable statistic in real time. For every positive scenario, where the Fed is cutting mid-cycle to good results like 1995, a good portion of cuts come because the economy is faltering. See 2001, 2007 etc.

One thing we can look at is what has done well in previous cutting cycles. A few sectors could benefit.

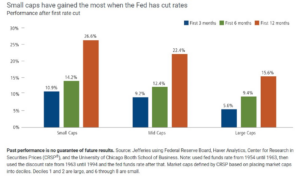

Real estate, both REIT’s and residential, would be the most obvious beneficiary of lower borrowing costs. We already talked about smaller companies, or small caps last month. They tend to be more leveraged than larger companies and lower interest rates could boost profits.

Another outperformer, perhaps not as obvious, is gold. Gold is a notoriously fickle investment but has rallied lately to all-time highs. This is partially due to the uncertainty in the world surrounding the upcoming election and tensions in the Middle East. But historically, gold can do well in environments where the value US Dollar is decreasing along with interest rates. Gold has outperformed the stock market since rate cuts were hinted at this spring.

For a lot of Americans, especially those in real estate, the upcoming rate cuts cannot come soon enough. We’ll be following as we prepare for what could be a potential new investing environment.

Enjoy your Labor Day weekend everyone!