One size does not fit all. We recognize that you need a financial plan and investment solution that is unique to you and what you are looking to accomplish. Whether you are a high-income earner looking to maximize the benefits of your stock options package or a seasoned executive within a few years of a transition to retirement, we have a service model with a solution that is unique to you.

Our Solutions

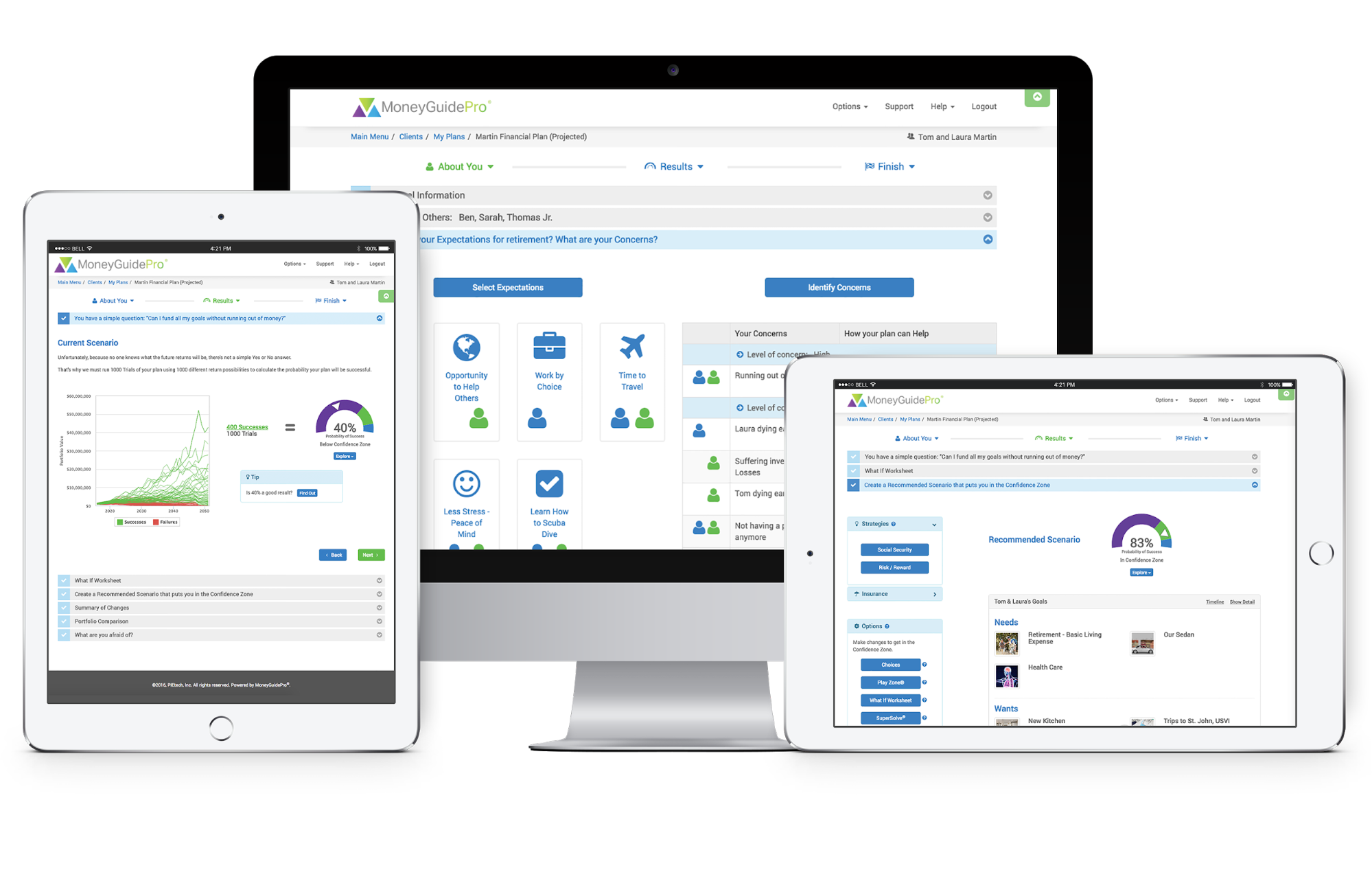

Retirement Planning

”Your situation is unique,

Timothy KenneyFounder

your financial plan should be too.

At Seawise Financial, we offer a retainer option so you can access a CERTIFIED FINANCIAL PLANNER™ professional regardless of if you need investment management or not.

While everyone’s situation is different, our typical engagement can include the following topics:

- A comprehensive financial plan to prioritize your goals and make sure you are on the right track

- Savings and cash flow planning

- Tax planning

- Retirement plan allocation recommendations

- Employee stock option analysis

- College planning

- Estate planning

- Insurance review

- Real estate review

- Ongoing communication as your situation changes

”You can’t predict. You can prepare.

Howard MarksAmerican Investor

Investment Management

We know your time is extremely valuable to you. Whether that is juggling a full-time job and family or wanting to pursue what you really love with your spare time, watching your investments is usually not on that list.

While doing it yourself is possible, most do not have the time, knowledge, or desire to manage their investments on their own. We offer a discretionary investment management program where we act as a fiduciary for you at all times.

What’s included:

- A professionally managed portfolio designed specifically for your risk tolerance and goals

- Low cost and tax efficient investment vehicles (mostly ETF’s)

- Ongoing monitoring and rebalancing when necessary

- 24 hour access to investment balances and on-demand performance reporting

- Ongoing education and updates