We hope you had a great holiday with your families. For those outside of Encinitas, we hope you are thawing out OK!

Along with the all the Christmas and New Year festivities, this is the time of year when those of us in the investment management industry start to receive their market outlooks for next year. Each year, most investment banks and asset management companies send out their predictions for the stock market, economy, and interest rates to try to help investors position their portfolios. For those of you that have never read one, the forecasts typically go something like this:

– Take the year-end price of the S&P 500 and add roughly 7-12%

– Take the ending yield on the 10 year treasury bond and add or subtract 0.75%

– Predict that the US economy will grow somewhere between 1.5-3%

Why 7-12%? Stocks return roughly 9% per year on average. Seems like a pretty safe range to predict if you are an analyst.

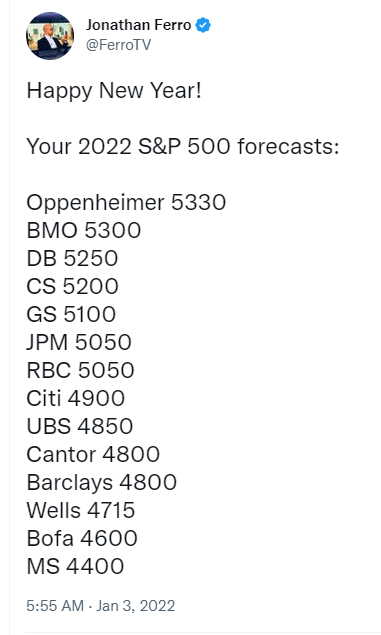

The problem with these forecasts? These are almost always wrong. The economy and markets are just too complex to be able to forecast with that kind of accuracy. Take a look at the predictions for where the S&P 500 were on January 3rd of this year:

As of this writing the S&P 500 was at roughly 3844. Congrats to Morgan Stanley’s analyst who got their prediction the closest at 4400. The rest, especially the analysis that forecasted the S&P 500 over 5000, were off substantially. Don’t ask how badly they got interest rates wrong.

I’m not trying to dunk on analysts here, just trying to show that it’s nearly impossible to predict something as complex as stock market returns in the next 12 months with any accuracy. BUT…in looking at some of the forecasts for 2023, the analysts and economists seem to have bucked the trend outlined above. They are almost all bearish on the economy and mixed on stocks. 70% of economists surveyed by Bloomberg think we’ll go into a recession next year.

The big banks are also more bearish on stocks than I can remember. The estimates on the ending value of the S&P 500 next year ranges from 4500 to 3675 with the median prediction coming in at 4000 – just a 4% increase from the price as of this writing. This isn’t a terribly appealing outlook considering you can get 4% by just buying a risk-free T bill.

It’s completely understandable for investors to be nervous in light of a potential upcoming recession – especially for those approaching retirement. So, should you change your investment strategy based on these abnormally lackluster predictions for stocks and the economy next year? You know the answer – probably not.

There is a saying that economists have predicted 11 of the last 5 recessions in the US. Again, it is really hard to predict something as complex as the global economy with any kind of accruracy. That said, there are plenty of metrics showing that the economy has slowed significantly and there is a good chance that economists will be right about a recession next year.

If you’re concerned about investing before a recession and want to wait for the dust to settle before putting money to work, it’s likely the stock market will have likely already moved on well before a recession ends.

Even if you can time the recession, it gets even tougher to try to position your portfolio as there are recessions of varying degrees of severity. We all recall what happened in 2008. Not as many remember the shallow recession of 1990 where stocks sold off 20% before resuming their upward trend (we’re down roughly 20% as of this writing). Ben Carlson:

“Oddly enough, even if you told me the exact economic scenario for the coming years, I’m not sure I could tell you how the financial markets will react.

It would make sense for the stock market to roll over with a hard landing because earnings would likely fall in a recession.

But you could also make the case that stocks would bottom well before the onset of a recession assuming that’s already been priced in.

I’ve reached the point in my investing career where I’ve given up on trying to predict the timing of the next recession with the understanding that I know there will be one at some point no matter what I think will happen. You can’t control the economy but you can control your reactions to the inevitable ups and downs it will give us.”

What Kind of Landing Are We Going to get in the Economy

It’s understandable to be nervous about investing, and staying invested, with a potential looming recession. For those on the fence or thinking of changing your allocation to become more defensive, I’d offer a hypothetical:

1) You could have invested in January of this year. Optimism was high, stocks were at all-time highs, interest rates were low (bad for bond yields), and the Price/Earnings ratio for stocks was over 21 (all-time high valuation).

2) Investing / staying invested now. Optimism is low, interest rates are higher (better for bond investors), and the Price/Earnings ratio is 17 (roughly average valuation).

Which scenario do you think will offer better future returns? I know which one I would choose.

And finally, as we reach the end of the year, I really hope we can retire the word “inflation” from these updates for a long time. Here’s to a great 2023!