We hope everyone had a great Thanksgiving with their families. It’s hard to believe that we’re only a month away from closing out 2024.

Thankfully we survived another election season. The market rallied afterward (like it did the prior 2 elections), but there were some notable moves based on the results.

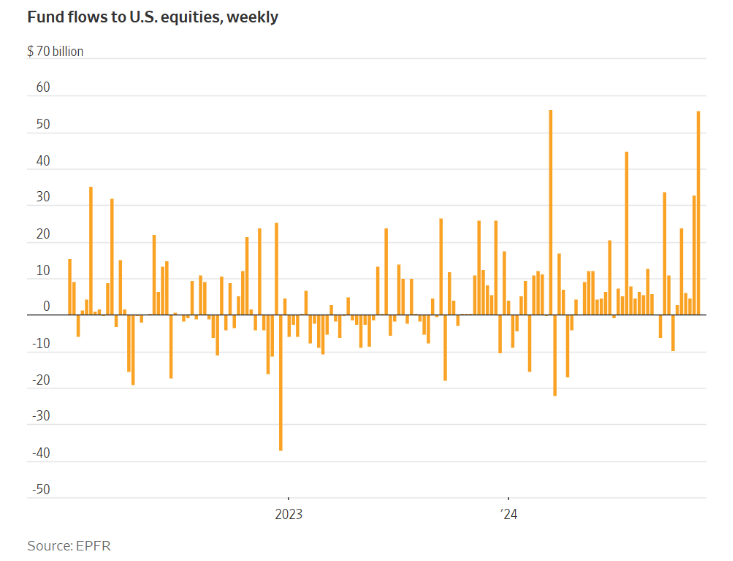

Investors piled into some of the perceived beneficiaries of a Trump presidency including crypto (namely Bitcoin and Coinbase), Tesla, small cap stocks, and the US Dollar. Bonds, non-US stocks, and gold sold off.

So we now have an administration that is vocal about being business friendly, reducing regulations, and spurring more growth – all while the Fed is planning to lower interest rates. Households are now as bullish on stocks as they’ve been…ever.

According to data from the Conference Board, the percent seeing higher stock prices 12 months hence surged to 56.4, a record.

How long can this rally keep going? Perhaps a while according to Kelly Evans from CNBC – assuming the administration delivers on its promises.

The short, the obvious answer is that in the long run, stocks always go up. The more tactical answer is that big breakout moves like these – especially the move in small caps today – often precede more long-lasting rallies. This was the third-biggest opening gap higher in the Russell 2000 today since it began trading in 2000, per Bespoke. The only bigger ones were in 2008, and 2020, which were near bottoms, not tops.

The larger issue, though, is the vexing combination of (a) huge fiscal deficits – of which interest costs are now a large part; (b) a massive debt pile that is generating those interest payments; and (c) rising interest rates. This would seem to leave very little room for the expansionary fiscal policies Trump would like to see, including extending the personal tax cuts that will expire at the end of next year.

If the GOP can trim government spending, and deliver strong growth, and yields calm down, today’s euphoria makes sense. And right now, markets are giving them the benefit of the doubt.

While there are any number of topics we can focus on post-election, here are a few things we’ll be watching for as we head into 2025:

What happens to the tax cuts set to sunset in 2025?

With a Republican sweep, you have to think that the tax cuts Trump enacted in 2017 will be extended in some form regardless of its impact to the federal deficit. This was probably going to happen even with a split government but it will be interesting to see what actually makes it into the new law. Some items on the agenda include increasing the Child Tax Credit, increasing the QBI deduction for business owners, and keeping the current elevated gift and estate tax exemption in place. For those of us in high cost of living states, I’m sure many want the state and local income tax limit (SALT) removed, but it might be wishful thinking.

Will tariffs be implemented?

Trump has stated he would impose a 10-20% across-the-board tariff on imports and a 60% tariff on all Chinese goods. This would likely end up costing consumers in the end as companies would just pass on those additional costs to us.

While some economists are expecting the tariffs to be more of a start for negotiations, companies are taking them seriously. Here’s the CEO of Black and Decker talking about tariffs during an earnings call this month:

“If those went up to 60%, which is where some of the rhetoric has been, it would add–that move from 25 point so 60 points would add $200 million of annualized tariff expense. Again, we don’t know if that will happen or won’t happen. It is certainly on for the quickest things that could happen because it could kind of happen with the stroke of a pen as opposed to a whole new framework needing to be put in place.”

Will stocks be able to justify their elevated prices?

The S&P 500 has hit new all-time closing highs 51 times this year. The market now looks overvalued on a number of metrics. A popular measurement called the Shiller P/E (or CAPE ratio), has the market approaching record valuation levels.

It’s possible stocks can grow their earnings enough to justify these prices. Plus, high valuation levels don’t always have to correlate to an upcoming recession or crash. Warren Buffett and Berkshire Hathaway aren’t taking any chances though. Berkshire now has over $325 billion in cash on hand after selling shares in Apple and Bank of America throughout this year.

Is everyone too bullish?

The market has an uncanny way of doing the exact opposite of what everyone believes. Remember in 2022 when investors were bearish and the probability of a US recession was 100%? Well, the exact opposite is happening now.

Joe Johnson, 37, said he has waded into hot stocks including Nvidia, Tesla, and a crypto play, MicroStrategy. His portfolio has swelled this year, and he is feeling so good about the market that he is thinking about pouring his cash pile into stocks. He is eyeing such strong industrial giants as Caterpillar and Deere, which he believes will benefit from a strong economy.

“I am bullish on the market,” Johnson said. “The euphoria everyone is feeling is warranted.”

WSJ via A Wealth of Common Sense

Not to pick on Mr. Johnson, but it reminds us of a saying by the late Sir John Tempelton that goes:

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.

Let’s hope we don’t need to have a funeral for this bull market just yet.

And finally, we know that art is in the eye of the beholder. And while we’ve never been mistaken for art experts (“Dogs Playing Poker” may have been displayed on the wall of an old college house), we have to admit we’re at a loss here. A banana that is duct-taped to a wall could be worth over $1mm.

The yellow banana fixed to the white wall with silver duct tape is a work entitled “Comedian”, by Italian artist Maurizio Cattelan. It first debuted in 2019 as an edition of three fruits at the Art Basel Miami Beach fair, where it became a much-discussed sensation.

Now, the conceptual artwork has an estimated value of between $1 million and $1.5 million at Sotheby’s auction on Nov. 20. Sotheby’s head of contemporary art, David Galperin, calls it profound and provocative.

“What Cattelan is really doing is turning a mirror to the contemporary art world and asking questions, provoking thought about how we ascribe value to artworks, what we define as artwork,” Galperin said.

Better than paying $1.3mm for a .GIF of a rock I guess. At least you can eat the banana.