We hope your spring is off to a good start. Usually this time of year brings a bit of brightness in Encinitas – longer days, sunnier skies, and the relief of getting past tax season. Not so much this month. Let’s unpack some of the chaos from April and what it means for investors going forward.

Market Update

Without exaggeration, April 2025 was one of the most volatile months in market history. Surprisingly, as of this writing, the US markets have nearly clawed their way back to where they were before the tariffs were announced. But if you’ve been watching the movements daily, it certainly doesn’t feel like it.

President Donald Trump rolled out the proposed tariff strategy on April 2nd, impacting a wide range of goods from electronics and auto parts to agricultural products. Investors initially hoped for a last-minute delay or scaled-back version of the policy. No such luck. Markets sold off hard in early April, with sectors tied to manufacturing, tech hardware, and global trade taking the hit.

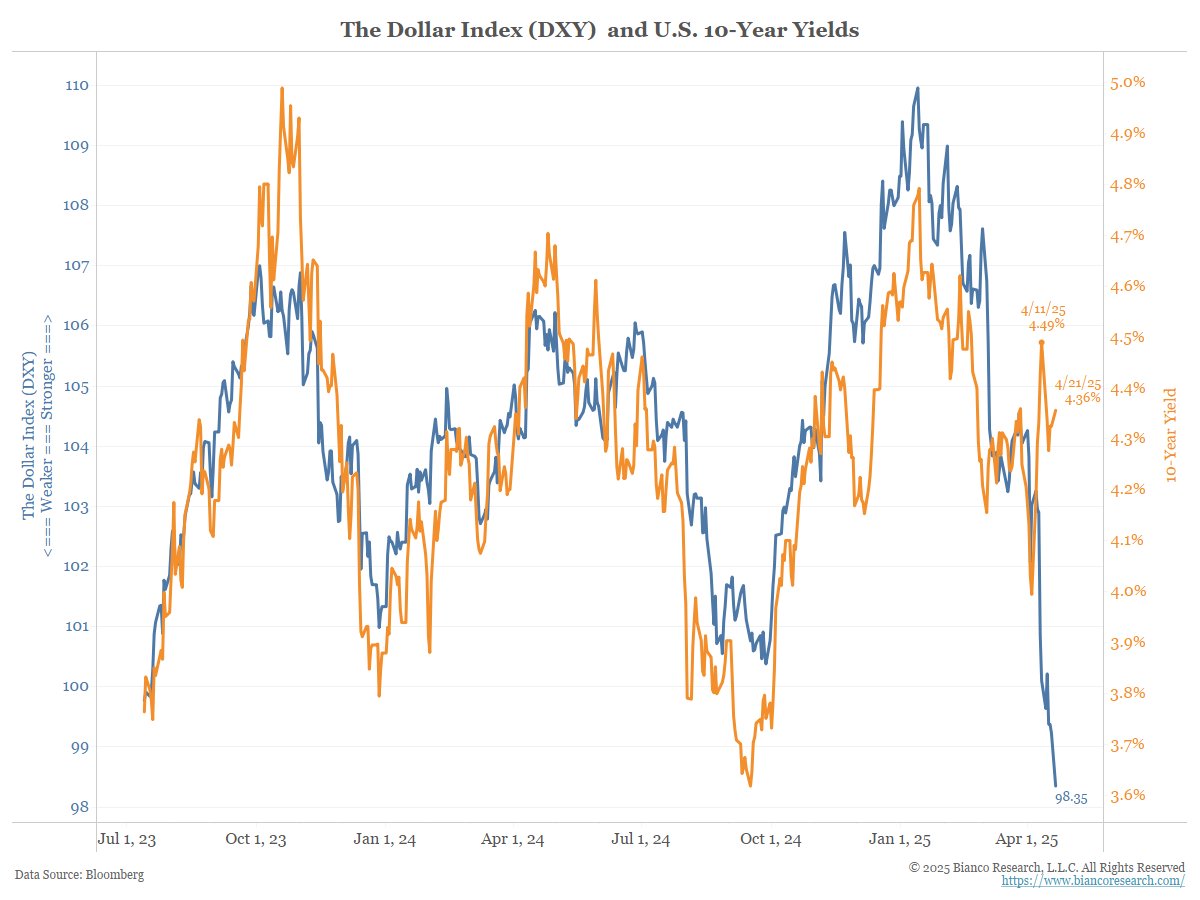

But it wasn’t just equities. The U.S. dollar and bonds sold off as well. You can see in the chart below that the U.S. dollar and bond yields (which move inversely to bond prices), usually trade in lockstep. Dollars and bonds are typically thought of a safe haven during periods of market stress. That correlation broke earlier this month. This indicated a pretty scary result to the tariff announcement – investors were dumping all U.S. assets of every type.

Tariffs: A Policy That Hurts More Than It Helps

Are tariffs good policy? We’ll let Dr. David Kelly of JP Morgan answer this:

I was at a conference last week and a financial advisor asked me what I thought he should say when a client asked him what was so bad about tariffs.

The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity, and increase global tensions.

Other than that, they’re fine.

Ouch.

You can find similar critiques just about anywhere. Economists, analysts, and market participants overwhelmingly agree: tariffs are bad policy. The only people not aligned with this view? The ones actually implementing them. Even figuring out what is being taxed, how much, on which goods, and for how long, has been a moving target.

Thankfully the tone out of the White House changed quite a bit this week, suggesting a softening of their original stance. The US stock markets rallied – bonds and dollars did also. Unfortunately, the damage may have already been done. Estimates for US GDP growth is now -2.5% as of April 24.

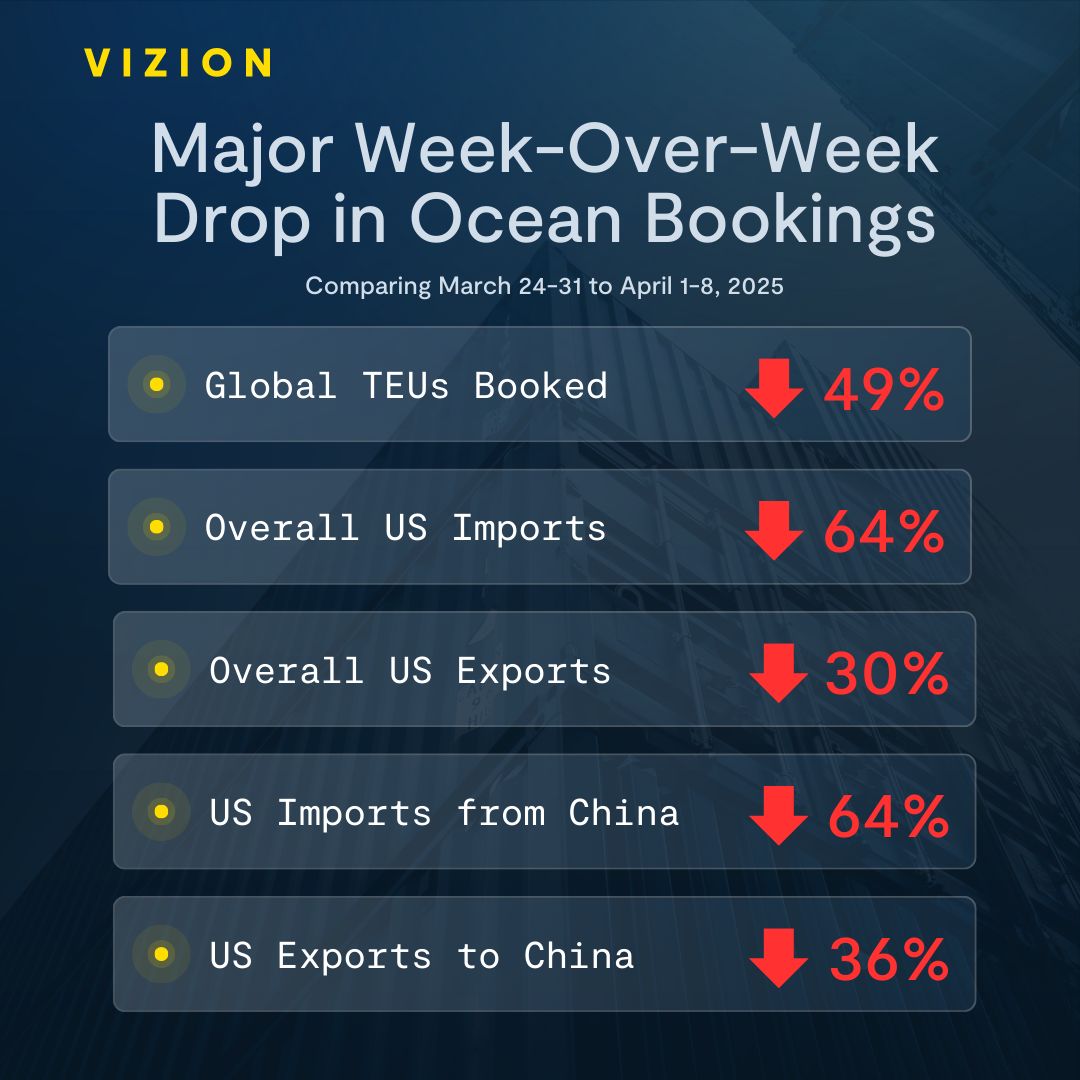

And we may just be scratching the surface. Shipping volumes are falling. Port activity is down. Trucking demand has plunged. Empty shelves might be next.

The chief executives of Walmart and Target privately warned President Trump this week that his sweeping tariff policy could disrupt supply chains and lead to empty shelves in the coming weeks, sources familiar with the White House meeting told CBS News.

What This Means for Your Investments

Here’s the part where we zoom out and remind ourselves – this is not the first time markets have faced uncertainty. And it won’t be the last. You already know this, but long-term investors are rewarded not for avoiding volatility, but for enduring it.

Holding is the hardest part because it combines all the feelings and potential regrets that can arise from both buying and selling.

Howard Marks once wrote,”it’s not the things you buy and sell that make you money, it’s the things you hold. Buying is the easy part of buy-and-hold. Anyone can buy-and-hope. It’s the hold part that’s hard.”

The Things That Make You Money

Just remember – the market has faced, and overcome, much worse. In the last 15 years we’ve seen a global pandemic, the worst financial crisis since the Great Depression, major wars and political instability, and a string of high profile bank failures.

And yet? The markets have always come back. New highs eventually follow – but not necessarily on our schedule.