Judging by the thermostats around the country, summer has officially started. We hope you are staying cool out there.

Most of Wall Street seems to have gotten the memo to go to the Hamptons – trading volume has really dried up this month. June 6th saw the lowest number of shares exchanged in a trading day in 18 years.

That lack of volume didn’t stop the march toward all-time highs – both the NASDAQ and S&P 500 both hit them in June before pulling back over the latter half of the month.

The S&P 500 has now reached all-time highs 31 times this hear This is also the best start to a presidential year in history.

It makes you wonder how long this can continue. Some analysts seem to think that the excitement around AI, and specifically Nvidia, has merely pulled future returns forward to today. Nvidia overtook Microsoft and Apple as the largest company on earth this month.

Which means that were seeing an increasing gap between Nvidia’s stock performance and its underlying fundamentals. The 174% year-to-date gain for Nvidia exceeds its expected revenue growth for the entire year (98%) by a wide margin.

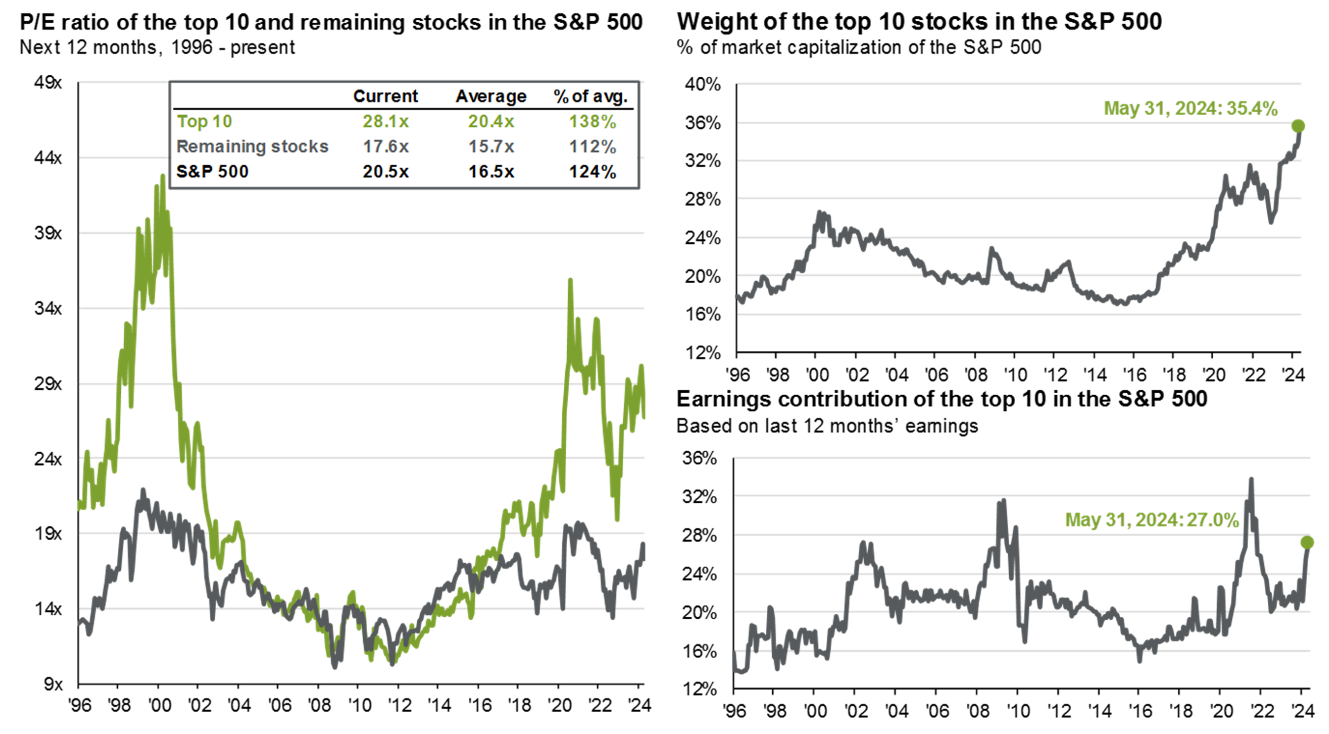

The comparisons to the dot com bubble are growing louder by the day. At a certain point a stock becomes so big it’s difficult to imagine them growing their earnings enough to justify their share price in the near term.

Stunning, Nvidia passes Microsoft and Apple as largest market cap. Combined, the three are valued at $9.9 trillion combined market value, 21.5% of the entire market capitalization of the S&P 500. The three are today LARGER than the capitalization of the ENTIRE S&P in September 2011, not a market low.

Including Google, Amazon, Meta, and Tesla, the Magnificent 7 have a $16 trillion combined market value, 34% of the S&P 500 and LARGER than the ENTIRE S&P as recently as February 2016, just over 8 years ago and most definitely nowhere near a market bottom.

Nvidia is valued at 42x and 78x trailing sales and earnings on an unsustainable 54% net profit margin.

Microsoft is valued at 14x trailing sales and 39x earnings on a 36.4% net margin.

Apple is valued at 8.6x and 33x trailing sales and earnings on a record 26.3% net margin.

These are crazy valuations for very large companies that can grow sales and earnings nowhere near as rapidly as they did over the past one and two decades. Microsoft and Apple traded less than 10x earnings at various points over the past 20 years.

A big positive, assuming the stocks in the Magnificent 7 are indeed overvalued, is that under the hood most other stock markets are not. Valuations of smaller companies, foreign stocks, and shares outside of the big 7 look reasonable.

It’s impossible to know if the outperformance of the Magnificent 7 will continue. This is one of the reasons investors should be diversifying across different sectors and asset classes. One thing we know, as Apple and Microsoft found out this month, is that the biggest don’t stay the biggest forever. Stay tuned.

In the meantime, enjoy your 4th of July!

And finally, be careful who you assign as a beneficiary to your retirement accounts. Jeffery Rolison, a P&G employee, put his then-girlfriend, Margaret Sjostedt, as a beneficiary on his 401(k) when they were dating in their early 20’s. They ended up breaking up 2 years later in 1989. He never updated his form.

Nearly 40 years after their breakup, Margaret is poised to inherit Jeffery’s $1 million retirement account because Rolison never updated his form. When he passed away in 2015, she was still listed as the beneficiary.

Someone had better check if Taylor Swift has an old retirement account.