It’s Spring Break time around Southern California. We hope everyone is enjoying the warmer weather and some potential time off with your families.

The market seems to have entered a transition as well, with the bears slowly joining the rest of the bulls after a long time in hibernation. The S&P 500 is almost up 10% on the year as of this writing – eclipsing many analyst expectations for the entire year.

Heading into 2024, Wall Street investment banks and research firms largely expected U.S. stocks to post positive yet underwhelming gains after a robust and forecast-defying 2023. Last year’s rally left investors to worry whether stocks could build on their gains as interest-rate and inflation threats lingered.

But that cautious outlook was shattered. A renewed wave of A.I. enthusiasm and reassurance by the Federal Reserve that recent sticky inflation had not changed its plan for three interest rate cuts this year, have sent stocks on a seemingly relentless record-setting run.

The estimates from strategists put the median target for the S&P 500 at 5,200 by the end of 2024, implying a decline of less than 1% from Friday’s level, according to MarketWatch calculations. Heading into 2024, the median target was around 5,000.

Wall Street Revamps 2024 S&P 500 Targets After Record-Setting Stock Market Rally

There have been a few economic stories this month that, in 2022, would have likely caused a big selloff in the market.

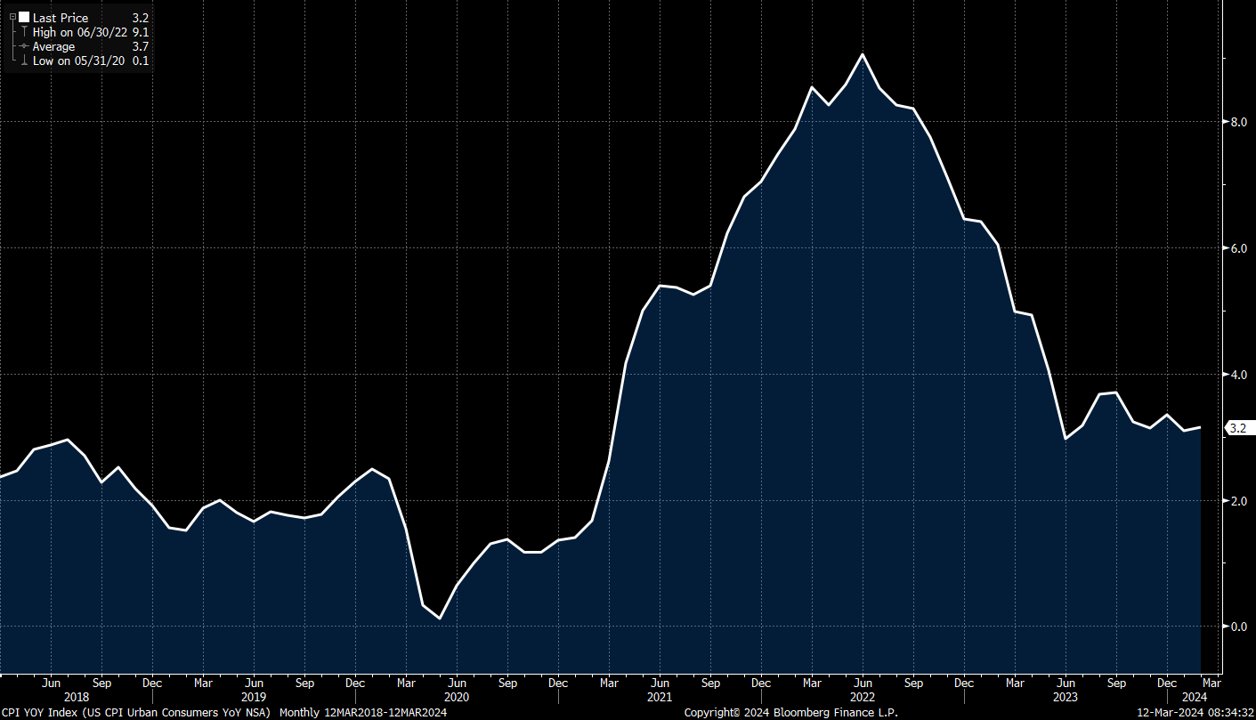

Inflation is proving to be stickier than anyone wants – it picked up again last month. In fact, CPI actually stopped going down last summer.

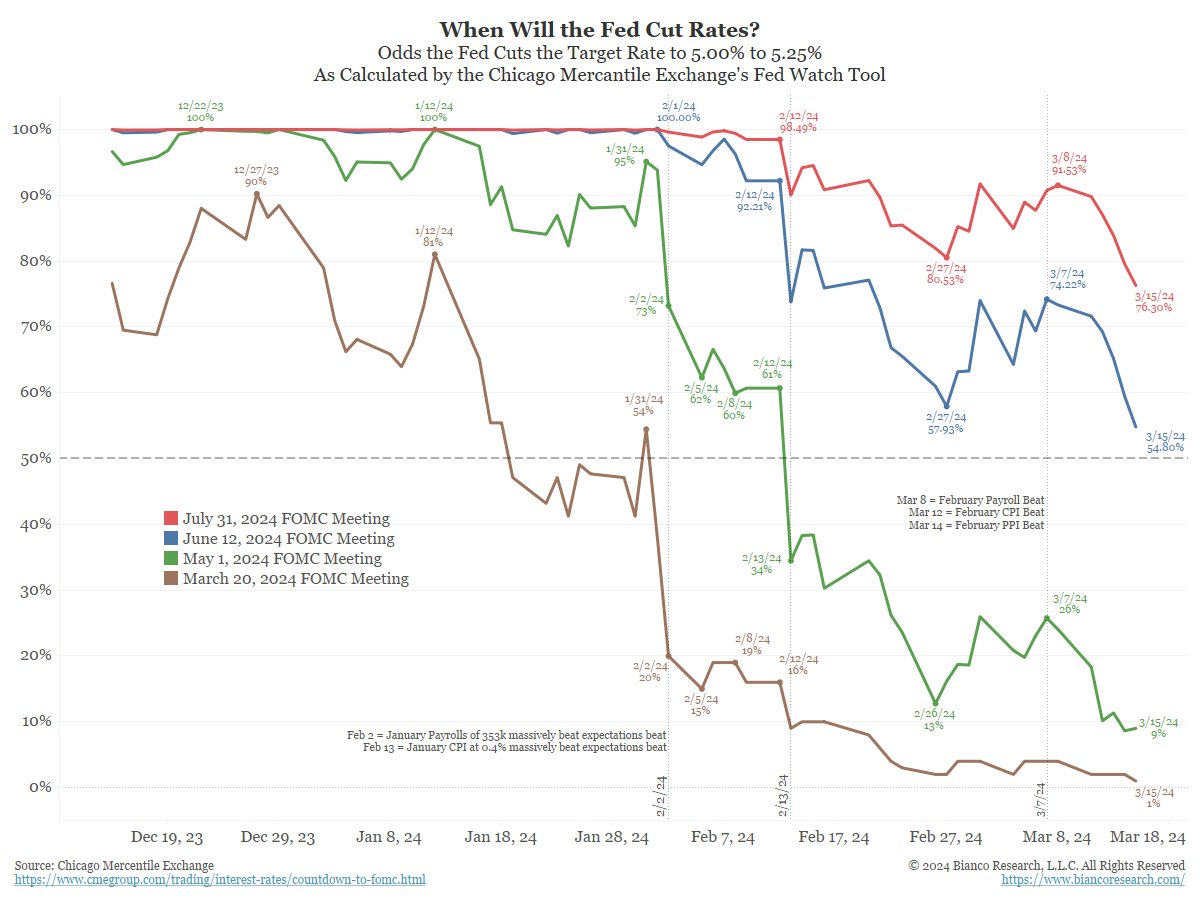

This has caused the market to start reducing the probability of rate cuts. At the end of 2023, there was a 90% probability for a March cut which didn’t happen this month. May and June cuts are now becoming less likely, and the Fed may not want to act right ahead of an election.

Home prices of the 20 biggest U.S. metros just hit a new all-time high as well. San Diego led all markets with a +11.2% gain year-over year. These gains, combined with mortgage rates at or above 7%, are contributing to the most unaffordable housing market in history.

These announcements would have likely caused the market to go haywire not too long ago as inflation was public enemy number one. But not in Q1 2024, as the market is looking past inflation right now. The focus is now on positive earnings and excitement about an economic revolution led by A.I. How optimistic should we be about this? Here’s Blackrock, the world’s largest asset manager, earlier this month:

Sales, earnings, and forward guidance from some of the largest names in tech have unequivocally crushed even the loftiest expectations. The subsequent price moves higher have been noteworthy – but contrary to conventional intuition – these stocks have gotten cheaper arguably, as their breathtaking prowess at cashflow generation outpaces their current corresponding price appreciation.

…the A.I. gold rush is in our view a secular phenomenon. Its impact on productivity (and therefore the economy) should be a stunning catalyst for future growth – and we view this as early innings.

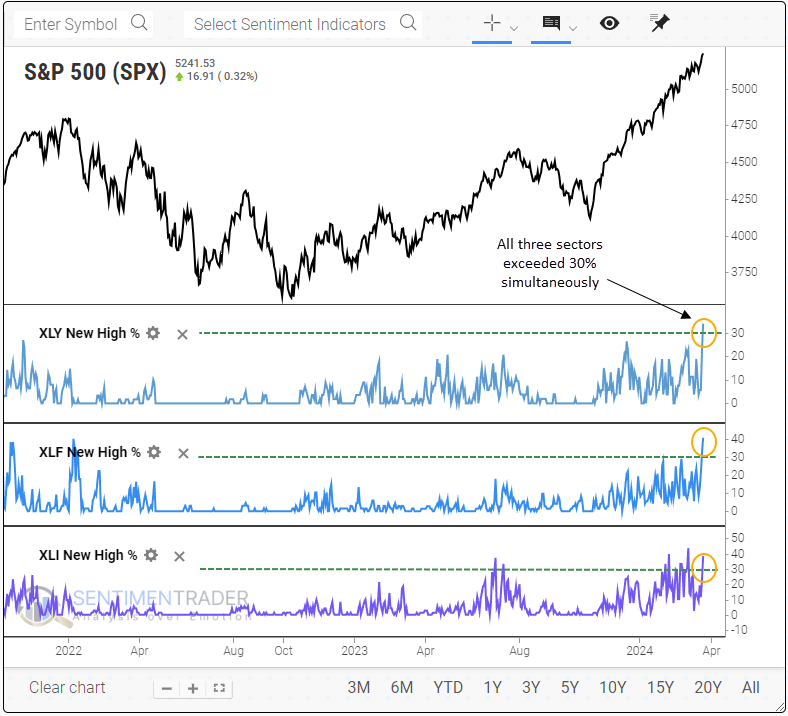

Wow. And it’s not just A.I. and technology stocks contributing to the gains anymore.

With a significant number of stocks in economically sensitive sectors like Consumer Discretionary, Financials, and Industrials registering annual highs simultaneously, the uptrend in the world’s most benchmarked index should persist. Indexes rarely peak when participation is broadening, like now.

Of course, there are always negative forces out there to pay attention to, and the sheer upward move of the market in such a short period should be watched. The market can act as a rubber band sometimes, and a snap back wouldn’t be out of the ordinary. We haven’t had a 2% pullback from a closing high in since October of last year.

The market averages between a 5-10% correction most years and having one now would not be unexpected. There’s also a chance that inflation reemerges to a point that the Fed takes rate cuts completely off the table. And there’s always a risk out there that that could come out of the blue.

But there’s also a a case to be made that we’re actually living in the Roaring 20’s right now – and that is unbelievably exciting.

And finally, it’s March Madness time and the tournament is down to its final 8 teams (including San Diego State!). Some of you might have filled out a bracket at work and might be wondering – what are the odds of filling out a perfect bracket? It’s MUCH higher than you might think.

While anyone has a chance to get it completely right, odds are 1 in 9.2 quintillion, according to the NCAA.

In other words, as Tim Chartier, a mathematics and computer science professor at Davidson College in North Carolina, told CBS News, it’s like picking a single second in 297 billion years. “It’s very difficult,” he said.

Yes, I’d say so. With all 22 million brackets on the ESPN site suffering at least one loss by the second day, we’ll just have to wait until next year to try for a perfect bracket. For those who can’t wait that long, there’s always hockey.

Surprise March Madness Wins Lead to Another Year Without A Perfect NCAA Men’s Bracket