We hope everyone is having a great start to 2024! Hopefully your New Year’s resolutions are still intact.

With the stock market finishing last year on such a high note, we’re picking right up where we left off. New all-time highs are being reached as of this writing.

* S&P: closes above 4,900 for the first time ever

* S&P and Dow: 6th record close YTD

* NASDAQ-100: 7th record close YTD

* S&P: hit a new intraday all-time high

* Dow: hit a new intraday all-time high

@carlquintanilla

Here is a look at the round trip in stocks over the last 3 years.

Why such a sharp turnaround in prices since last October? The underlying economic news just keeps getting better. The economy grew more than expected in the 4th quarter, 3.3% annualized instead of the 2.0% estimate.

Inflation data continues to improve as well, with most measures showing a slowing in price increases.

In fact, you can pick just about any inflation measure and we’re trending in the right direction – producer prices, import prices, inflation expectations from consumers and businesses, used car prices, etc. – all heading down. This has the market expecting the Federal Reserve to finally ease up on monetary policy and lower interest rates throughout 2024.

So, what happens now for investors? Should you be wary of all-time highs or think about getting more defensive? Perhaps surprisingly, the data says no.

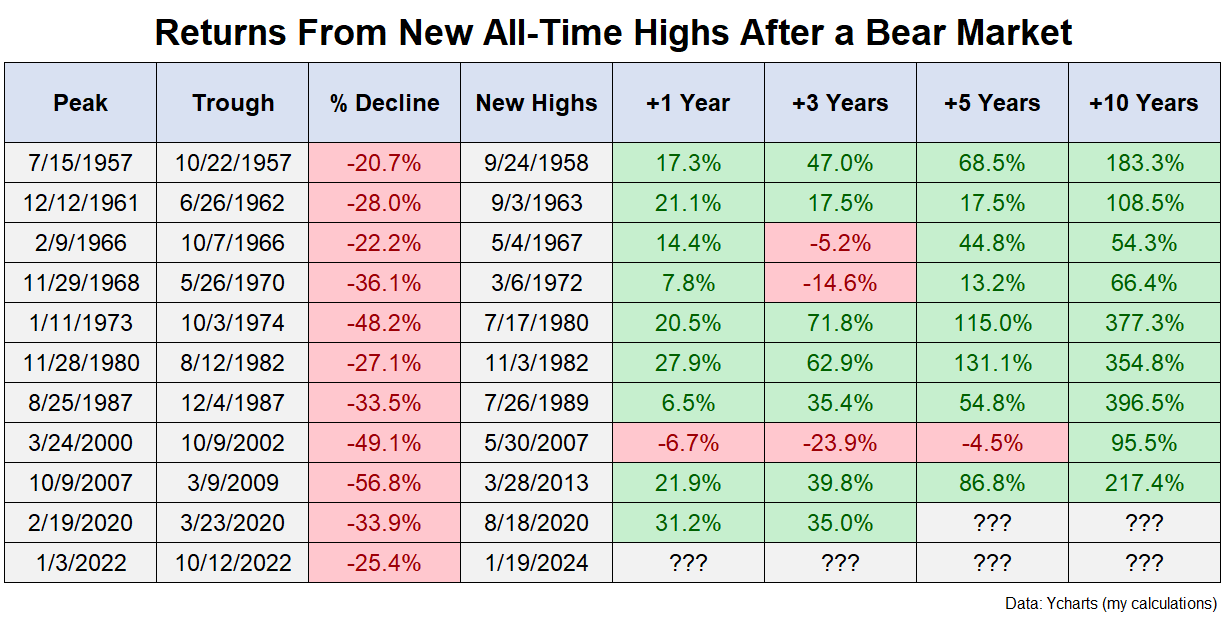

Most of the time new highs are followed by more new highs. The average one, three, five and ten year returns following new highs were +16%, +27%, +59%, and +206% respectively.

That’s pretty good.

Really the only time new highs were hit and another bear market quickly followed was in 2007. New highs came in 2007 while the peak for the Great Financial Crisis came in October of the same year.

The early 1970s experienced two dreadful bear markets in short order as well.

I don’t know what happens from here. It’s anyone’s guess.

What I do know is that thinking and acting for the long term is typically rewarded when it comes to the stock market.

Staying the course still works.

New All-Time Highs After a Bear Market

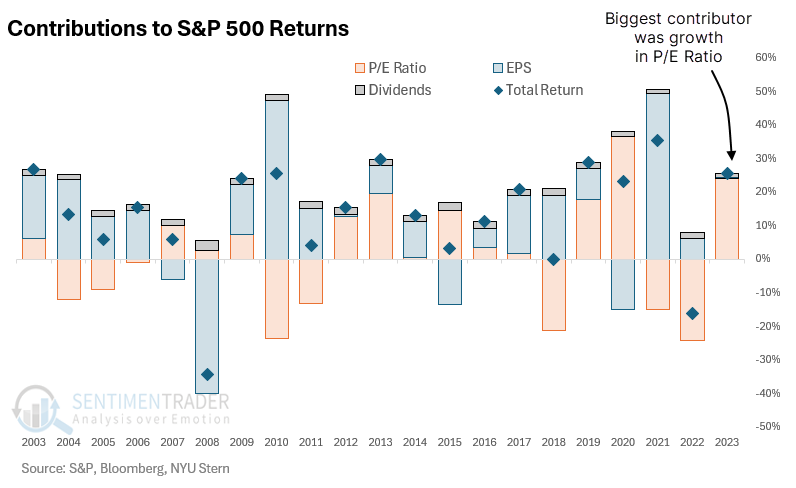

All that said, we still have a few concerns we’re monitoring. First off, we’ll need to see big earnings increases this year following the gains in stock prices that we’ve seen.

Almost all of the S&P 500’s gains last year were due to a multiple expansion.

Investors were willing to place a higher valuation on an almost imperceptible rise in earnings. They assume that earnings this year will justify the increase in valuations.

Strangely, the good news for the economy and rise in stock prices are not spilling over to other areas like the stocks of smaller companies. That tells us that smaller businesses are still struggling with higher borrowing costs, and we’ll want to see their performance catch up to their larger company peers if the economy is really as strong as we hope.

The S&P 500 closed at an all-time high.

The Russell 2000 is still in a bear market, down more than 20% from its high.

That’s never happened before.

Lastly, we’re still not out of the woods for a recession in 2024 – as unlikely as it feels right now.

Many families were able to shrug off higher rates because they had built up savings or paid off debts earlier in the pandemic.

Those buffers are eroding, however. The extra savings are dwindling or already gone, according to most estimates, and credit card borrowing is setting records. Higher mortgage rates have slowed the housing market. Student loan payments, which are paused for years during the pandemic, have resumed. State and local governments are cutting their budgets as federal aid dries up and tax revenue falls.

“When you look at all the supports that consumers have had, a lot of those are fading,” said Dana M. Peterson, chief economist for the Conference Board.

The U.S. Seems to Be Dodging a Recession. What Could Go Wrong?

Having said all that – if you told us last year that we’d begin 2024 with falling inflation, record-low unemployment, falling energy prices, and rising confidence amongst consumers and small businesses, we’d take that anytime. Here’s to a great rest of 2024.

And finally, with the cost of everything skyrocketing over the last 2 years, it’s nice to find a deal on any type of service. Interested in a free pool cleaning? If so, it comes with a catch: you have to let the company’s employees skate it.

Steve Alba, the van’s owner, for the past few decades has offered a very specific type of service: For a few hundred bucks, he’ll drain and clean out disused, rain-filled pools. If homeowners will let him and his friends skate the pools once they’re empty, it’s free.