There’s really no way to sugar coat it – the markets have had an awful first 1/3 of the year. As of this writing, most indices (stock and bond) are down almost double digits. The tech-heavy NASDAQ is down almost twice that. Even safe havens like gold haven’t helped protect investors from the downturn so far. Inflation, and the threat of the Federal Reserve hiking interest rates until it comes down has just been too strong for any asset to rally (save for the US dollar and certain sectors like energy).

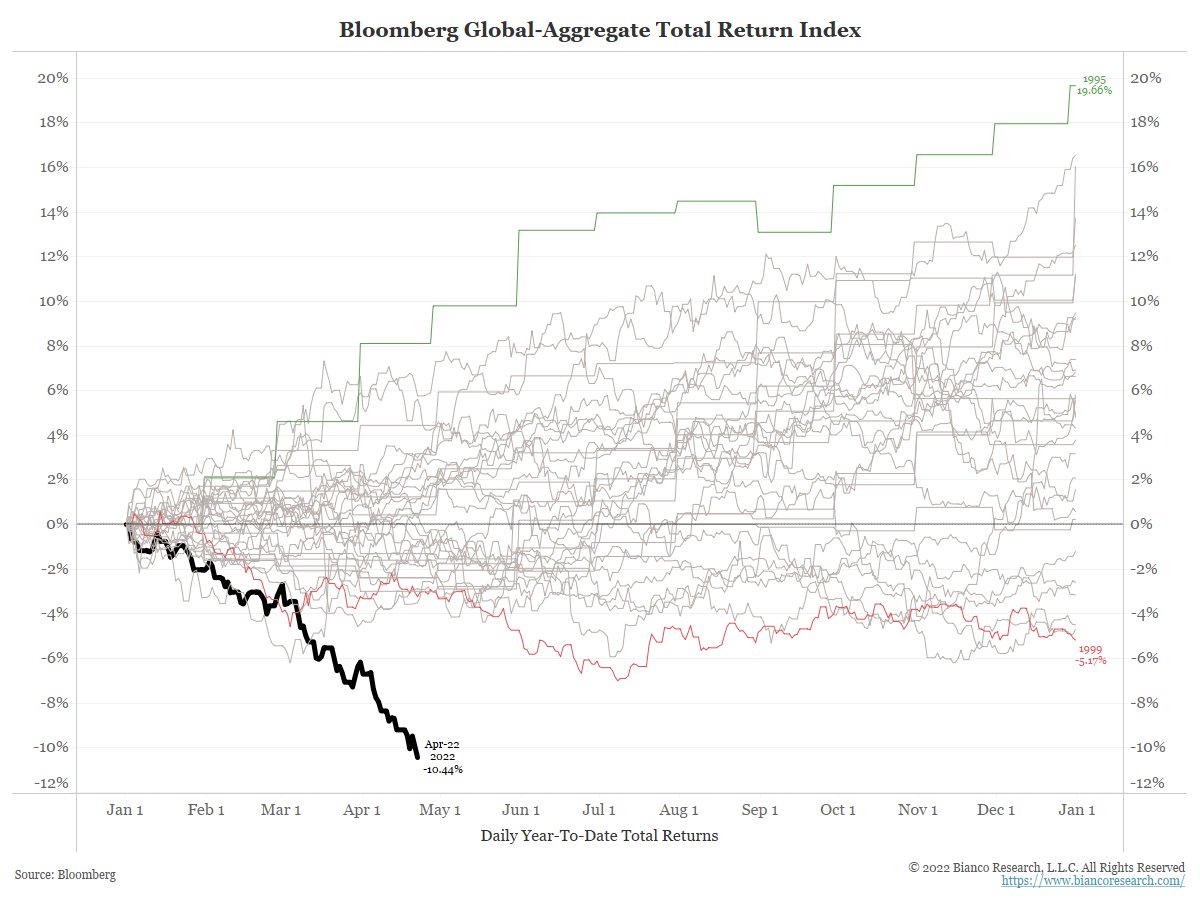

What makes this year so difficult is that diversification hasn’t really helped so far. Besides areas that benefit from higher prices like energy and commodities you really haven’t been rewarded by being diversified. Bonds, the traditional safe haven, are having one of their worst years of all time in anticipation of interest rate increases. The chart below shows the intra-year performance of US bonds since 1980.

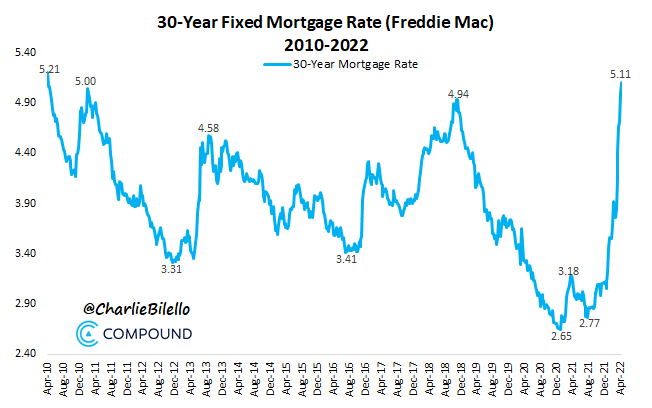

If that wasn’t enough, mortgage rates have spiked over 2% so far this year to their highest levels since 2010. You have to go back until 1980 to see an increase this sharp.

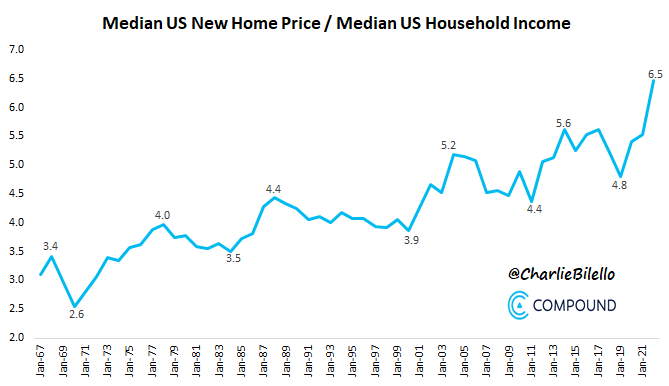

Not surprisingly, with the increase in mortgage rates and continued appreciation in home prices, we now have the most unaffordable housing market of all time.

Is there any good news on the horizon for long-term investors? Perhaps. First – inflation may have already peaked. Per LPL Research, used car prices and the backlog of various ports are starting to come down:

Also, those of us that own bonds usually don’t have to withstand multiple years of negative returns. The increased income generated from the interest rate increases usually end up in increased total returns.

The US bond aggregate is down -9.4% YTD.

1931 is the only year in US bond market history that comes close (-9.1%).

Returns the next 5 years:

1932: 16.2%

1933: 7.4%

1934: 13.4%

1935: 8.9%

1936: 8.2%

Lastly, you may start hearing about 1994 – as in, the last time the Fed was able to raise interest rates, cool inflation, and not send the economy into a recession. Some big market players, including the CIO of the world’s largest asset manager Blackrock, are leaning toward this direction and think the strength of the economy can withstand whatever inflation and the fed throw at it. Could stocks actually end the year higher like they predict? We’ll see, but expect a bumpy ride.