Happy New Year! It’s that time of year again – where we resolve to improve our work and home life, lose 10 pounds, cut back on sugar and alcohol, and get our financial house in order. It’s also almost the time of year when we abandon those resolutions by the 3rd week of January.

We can’t help you motivate to get to the gym, but we can give you some quick ways to get yourself set up financially this year. Here are some easy things you can do now:

Increase your retirement savings

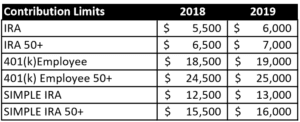

Retirement plan contribution limits increased for 2019! You can now save a bit more in all of your retirement accounts: now $6000 for IRA’s (up from $5500) , $19,000 in your 401(k) or workplace plan (up from $18,500). The catch up provision for those over 50 stays the same at $1000 for IRA’s and $6000 for 401(k)’s. Business owner? Your SEP IRA or Solo 401(K) contribution limits are up from $55,000 to $56,000 (subject to income limitations).

*Source http://blairbellecurve.com/new-year-new-limits/

Adjust your tax withholding

I wrote about this earlier this year when talking about taxes, the IRS made changes to the withholding tables in 2018 and you may be in the unfortunate situation where you did not withhold enough taxes from your paycheck last year. No one likes to write a check to the IRS from your savings account come April 15. You can use the IRS withholding calculator here or better yet, consult your CPA. Speaking of your savings account….

Check your interest rate

Don’t let your bank or brokerage firm get away with not paying you on your savings! Just because short term interest rates have been going up doesn’t mean your bank will automatically raise them also. I’ve checked a few rates for clients lately and some of them are downright embarrassing. Go to your bank / brokerage firm website to see what your savings or money market account is actually paying for an interest rate. Compare that with some of the offerings on Bankrate. Adjust accordingly.

*Caveat – there is some nuance to this based on FDIC and SIPC insurance, account minimums, lockups etc. Do your homework. Everyone got excited when Robinhood announced a 3% insured checking and savings account last month until it came out that they never applied for either type of insurance. Plus, if the 10 year Treasury is only paying 2.70% how are they paying 3%? You can read more about that story and some other savings offerings here.

Rebalance your investments

Based on all of the market gyrations last year, you should take a look at your asset allocation and see if it is time to rebalance your holdings. New to rebalancing? Over time, your original investment mix of stocks, bonds, international holdings etc. will shift due to the ups and downs of the market. For diversified portfolios, over longer periods you tend to end up with more in stocks than you started with. This can add to additional returns but end up putting you over your original risk tolerance and making your portfolio riskier. When you rebalance you’re essentially selling an outperforming asset and buying an underperforming one. Basically the first rule of investing – buying low and selling high.

*Source – Fidelity

Review your insurance coverage

As your life changes, you should be reviewing your auto, homeowner, and other personal liability coverage with your insurance company on an annual basis. For one, you want to make sure that you have proper coverage on your policies. Also, you don’t want to miss out on any potential upgrades or discounts as insurers change their policies frequently. Angela Ayers, an executive with the independent Goosehead Insurance Agency, says “insurance carriers are known to change qualification criteria from year to year which may create additional options that were not available the previous year. You may be able to reduce your premiums or get better coverage for about the same premium by selecting another company”.

Start a 529 plan

For you parents out there, don’t sleep on the 529 plan. 529’s are a great way to save for college on a tax-deferred basis. You can invest contributions in a diversified portfolio and as long as you use the funds for qualified expenses like tuition, books, supplies, and even room and board the growth and withdrawals are tax-free. Also, 529’s were approved to be used for K-12 tuition in last year’s tax bill ($10,000 per limit per student). There are stipulations on contribution limits, early withdrawals, and beneficiary provisions which you can learn more about here.

Stop eating carbs

Just kidding. Carbs are awesome.

Have a great 2019!

Want to talk about any of these? Schedule a call here.