Well, it’s that time of year again. The kids are back at school, the weather is getting cooler, and we’re starting to think about turkey. And you know what that means, it’s tax planning season! 2017 marked some of the biggest changes to the tax code in a couple decades and the Wall Street Journal just came out with a big list of some of the major questions people have. We’ll highlight some of the changes and some things to think about below:

*This should not be considered tax advice, please talk to your tax advisor to discuss how this might pertain to your specific situation.

What’s changed:

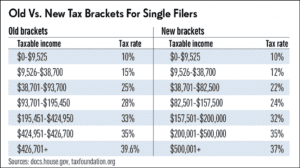

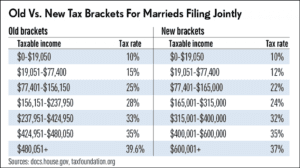

Tax rates

First off, your tax bracket probably went down slightly this year. You can take a look at the chart below to determine where you will be compared to 2017.

Source: IBD

The standard deduction / itemized deductions

Lots of changes here:

- The standard deduction has increased dramatically, which basically doubles to $12,000 for an individual and $24,000 for a couple. Which is great, but…

- State and local tax deductions are now capped at $10,000. What does that mean now?

- For those used to itemizing every year, especially for those of us who own homes in California, a big portion of your overall deductions come from those state and local taxes. Most of us will find that we will save more by taking the standard deduction instead of itemizing like before. The article thinks that this change will drop the number of people who itemize from 47 million in 2017 to 18 million this year.

- If you end up not itemizing this also means that things you used to deduct in the past like charitable donations and medical expenses would not apply anymore.

Child tax credit

Parents rejoice! Your child tax credit goes from $1000 to $2000 per child and you probably now qualify for the full amount since they also raised the phase out to qualify for the deduction from $110,000 to $400,000 for couples. This should give you new parents a bit of financial relief…until you start to look at how much college might cost in 18 years.

Miscellaneous

There are quite a few other changes in the law including how deductions work for meals and entertainment, investment fees, and the calculation of the Alternative Minimum Tax (AMT). It’s worth a look or at least a call to your CPA depending on your situation.

OK, I may not be able to write off as much as I did in prior years. What can I do to save on taxes between now and the end of the year?

Maximize retirement account contributions

Easy one here. Lower your taxable income and increase your retirement savings at the same time. The contribution limits for 401(k)’s is $18,500 in 2018 and $5500 for IRA’s. For you business owners, you can contribute up to 25% of compensation or $55,000, whichever is less in SEP IRA’s. Over 50? You get to contribute more using the “catch up” provision, which allows you to save an extra $1000 for IRA’s or $6000 for 401(k)’s.

Tax loss harvest

It’s been a challenging year in the markets and some of you may be showing paper losses on some of your taxable investment holdings. If you sell them at a loss you can take off up to $3000 from your income and carry the remainder of the losses forward to offset future income or capital gains. There are some nuances to this (mainly avoiding the “wash sale rule”) which you can read more about here.

Check your withholding

Ryan Carr, a CPA in Carlsbad CA, suggests you keep an eye on what you are withholding from your paycheck as you don’t want a big surprise come April:

Contribute to a Health Savings Account

Do you participate in a high deductible health care plan? You may be able to contribute money to a Health Savings Account (HSA). HSA’s are tax-deductible savings plans that allow you to pay for future healthcare expenses. You get a tax-deduction up front for the contribution, the account grows tax-deferred, and withdrawals that are made for qualified health care expenses are tax-free. That’s about as good as it gets as far as tax treatment. There are some specifics to who qualifies for these accounts, you can read more about these here.

Business owner? Make sure you take advantage of the new 20% deduction

One of the biggest changes to the law was the new 20% deduction for Qualified Business Income (QBI) generated by pass-through businesses. This deduction can also apply to real estate dividends and income from publicly traded partnerships. There here is a ton of fine print on this one which I won’t go into here, but you business owners and real estate professionals will want to consult with a CPA before the end of the year to make sure you are taking advantage of this.

Still confused?

Let us know. We know some great CPA’s and would be happy to refer you to someone that can help!