After what felt like a non-stop winter, it’s nice to see the sun here in Encintas again. We hope you’re having a great start to the spring.

The markets have taken a bit of a breather after the bank issues we had last month. Stocks have been stuck in a range for most of April. The S&P 500 and NASDAQ in particular have had a great start to the year thus far.

With the markets on hold for the time being, most of the questions we’ve been getting from clients haven’t been about a potential recession, the best growth sectors to buy, or the debt ceiling debate. Surprisingly, one word has been on the minds of just about all investors lately.

Cash.

Yes, for probably the first time in our career everyone seems to be excited for probably the world’s most boring asset class. Why? For the first time in over 15 years, we can get between 4-5% on our cash holdings thanks to the Fed’s recent rate hikes.

Let’s go over some of the different options investors have park cash right now:

1. Savings Accounts: This is your basic cash management investment available from your bank in either the normal or high-yield variety. The interest rates are generally lower than other options, but they offer easy access to cash when needed. The FDIC insures your deposits up to $250,000 per depositor, per bank. You can get an additional $250,000 in coverage for different account types like joint, trust, and retirement accounts. While rare, the risk of bank failures exist as we saw last month and is something you should keep in mind if you are holding funds over the insured limit.

2. Money Market Accounts: Money markets are issued by an investment firm or brokerage and invest in short-term instruments like US Treasury Bills, CD’s, and Commercial Paper (short-term IOU’s issued by big corporations to fund things like payroll). These are regulated by the SEC but are not FDIC insured or backed by the government. These are typically bought and sold like a mutual fund with access to cash in usually one day.

3. Certificates of Deposit (CDs): Basically, a bank savings account with a fixed interest rate for a set period, usually ranging from a few months to several years. CDs typically offer higher interest rates than savings accounts, but they require a commitment to keep the funds invested for the duration of the term. They carry the same FDIC insurance as bank savings accounts and are also subject to the same risk of bank failure.

4. Treasury Bills: Government securities that are sold at a discount to their face value and mature in less than a year. They aren’t insured but are backed by the full faith and credit of the U.S. government. You can buy T-bills through your brokerage firm or directly from the US Treasury.

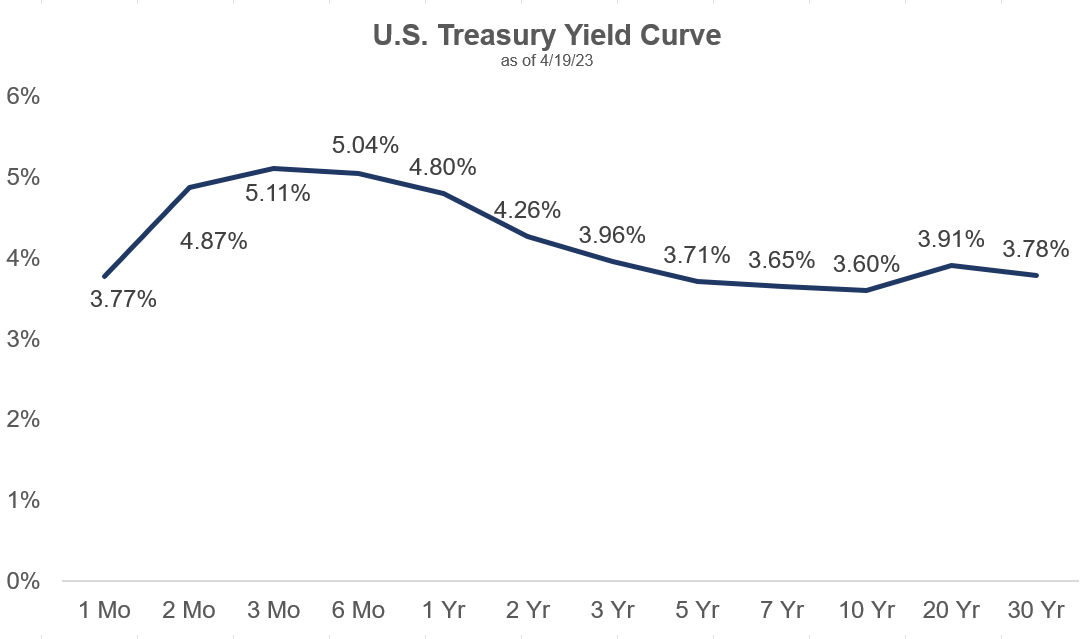

The best bang for your buck seems to be a US Treasury Bill. As you can see from the chart below, at the time of this writing you can earn over 5% by investing in a 3-month bill.

The Biggest No Brainer Investment Right Now

You’ll also notice that short-term rates are higher than long-term rates due to the inverted yield curve that exists now. So you can essentially get more return on your investment in a much shorter time frame. So that begs the question, why wouldn’t you just load up on 3-month T-bills in your entire portfolio? Well, a few reasons:

You might have to reinvest your T-bills for lower rates

You’ll have to renew your T-bill investment every 3 months into whatever rate the market dictates. They could keep going up, but at some point, the Federal Reserve will pause and eventually lower rates. Locking in longer rates gets you both the coupon payment plus any price appreciation. You can see the difference (sometimes substantial) in the 5-year total return in a 10-year bond vs. reinvesting 3 month T-bills during the last yield curve inversions in the charts below.

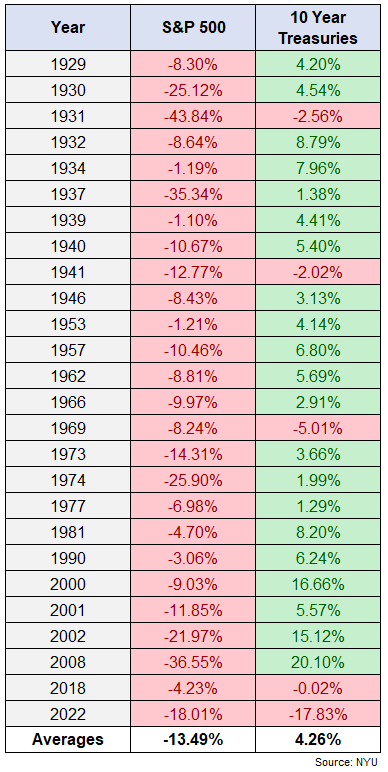

You might miss out on bigger gains if the stock market falls

A continuation on the point above, longer term bonds can increase in value during times of economic stress. If you’re investing longer term in something like a retirement account bonds can act as a great diversifier. As you’ll see in the chart, 10-year treasuries have provided a great hedge against stock market downturns throughout history.

The upcoming debt ceiling debate might impact T-bills

If the US government cannot raise the debt ceiling, it will not be able to issue new debt to pay for its obligations, including the interest on existing debt, salaries of government employees, and payments to contractors and entitlement programs such as Social Security and Medicare. We’re scheduled to run out of funds sometime in July or August.

If the US government cannot issue new debt it may have to prioritize its payments, and it is possible that payments on T-bills could be delayed or suspended. This could have all kinds of ramifications for the market as bills may become illiquid causing price declines.

We do have a guide on what’s happened in the past as we went through a contentious debt ceiling debate back in 2011. You’ll see a brief spike in the 1-month yield ahead of a last-minute agreement. Surprisingly, despite the US losing their AAA status as a bond issuer during this period, people actually flocked to longer term bonds as yields actually decreased (prices increased).

Bottom line – enjoy the higher interest rates on your savings and cash alternatives for now. Be wary of the debt ceiling issues if purchasing T-bills. Pay attention to FDIC insurance limits if using a high-yield savings account or buying CD’s. And try not to abandon longer term bonds in your portfolio.