When someone asks how the markets are doing this year, we’re now in a place where we have to ask, “which market”? As you’ll see below, the Dow, S&P 500, and NASDAQ are all in much different places year-to-date. The mostly blue-chip Dow is flat, the diversified S&P 500 is up 9.50%, and with the recent spike in the tech-heavy NASDAQ index now has it up over 30%! More to come on that.

This is happening in the context of two wildly different narratives that are dominating the headlines right now: the debt ceiling debate and the emergence of artificial intelligence technology.

Honestly, the debt ceiling debate shouldn’t worry investors. The bottom line is that Congress has raised the debt ceiling 78 straight times since 1960 and not doing so would cause an “economic catastrophe” according to Treasury Secretary Janet Yellen. Everyone knows this, and that’s why it’s almost certain they’ll raise it again right before the deadline.

Besides pockets of the short term bond market, there has been relatively little volatility elsewhere. This tells us that the market agrees that Congress will reach an agreement as well. If there’s any good news that comes with this dysfunction it’s that historically the markets move on quickly after we move past these debates.

*Update – a deal has been made this weekend and now needs to get past Congress.

Which brings us to artificial intelligence technology. You’ve undoubtedly heard of A.I. technology starting to have some incredible real-life applications. If you’re like us, anyone that’s uses ChatGPT for this first time probably goes through the following thoughts:

1) This is incredible.

2) How do I invest in this?

3) How many jobs will this replace?

Point number 3 is probably the toughest one to answer. Goldman Sachs believes automation could eventually impact 300 million jobs globally.

“Certain jobs will be more impacted than others, the report explains. Jobs that require a lot of physical work are, for example, less likely to be significantly affected.

In the U.S., office and administrative support jobs have the highest proportion of tasks that could be automated with 46%, followed by 44% for legal work and 37% for tasks within architecture and engineering. The life, physical, and social sciences sector follows closely with 36%, and business and financial operations round out the top five with 35%.”

A.I. Could Impact 300 Million Jobs

While this sounds dire, think about how many jobs the iPhone replaced vs. the new industries created after it came out. Yes, companies like Blackberry and Kodak went bankrupt as a direct result of the popularity of smartphones. But entire industries were created that didn’t exist before like mobile delivery, mobile payments, and social media. You’d expect A.I. to forge a similar path.

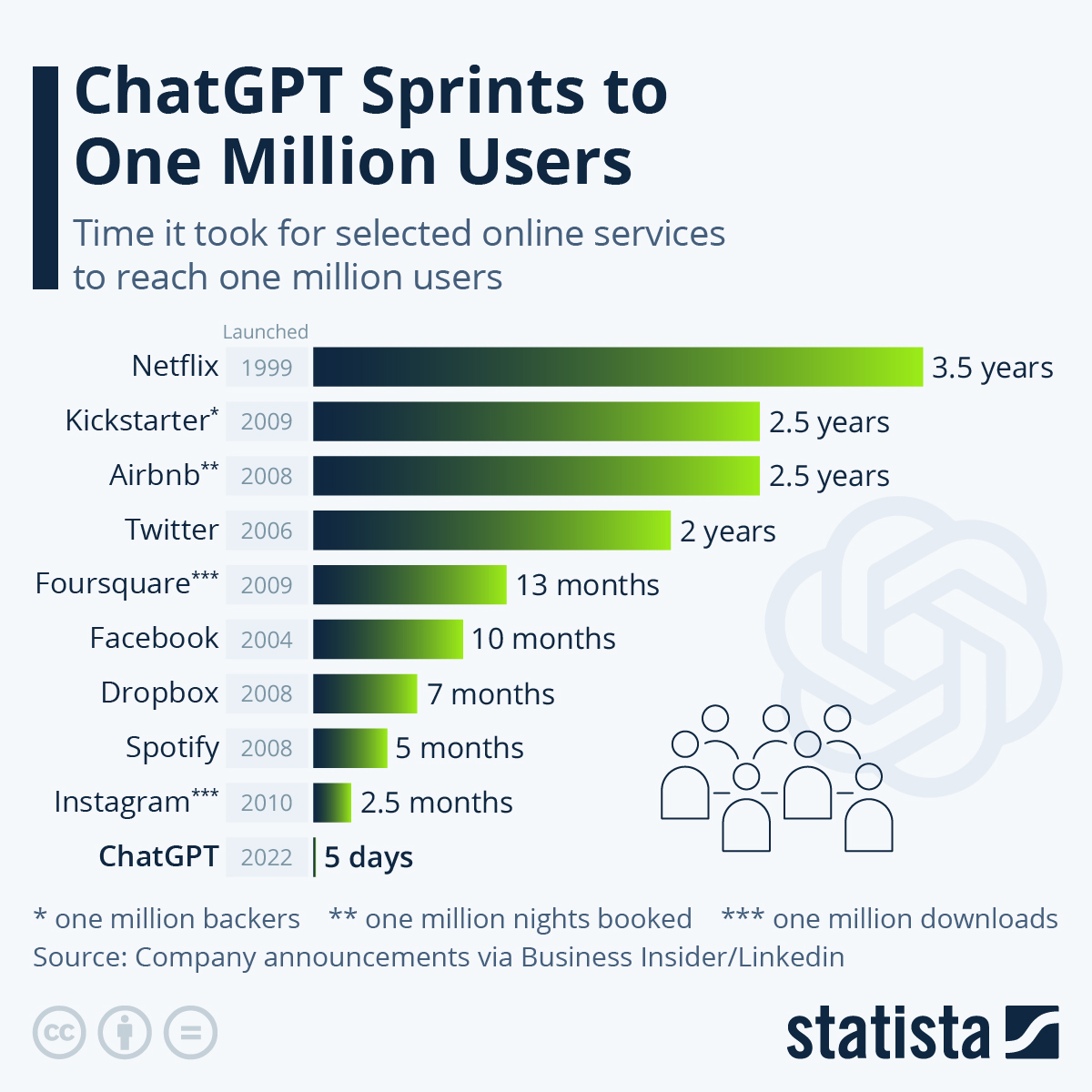

Perhaps A.I. brings about a new paradigm where we become 10x more productive than before? ChatGPT had one of the most popular releases of any service in history and now has roughly 100 million users. Hedge fund manager Paul Tudor Jones thinks that A.I. could add nearly 7 trillion to the world economy and 1.5 points to productivity growth over the next 10 years.

“Jones told CNBC in a Monday interview that the massive adoption of ChatGPT has changed his outlook completely on inflation and the stock market within the past six months. That’s because a “productivity boom” could be unleashed on the economy that helps drive inflation lower and the stock market higher.

Previous productivity booms in the economy occurred in the late 1950’s after the US invested in its infrastructure, in the 1980’s following the introduction of the PC, and in the 1990’s following the introduction of the internet.”

The biggest investment success in A.I. for investors so far? Technology company NVIDA. They gained a whopping $184 billion in market cap on Thursday after releasing earnings.

While plenty of firms will be fighting to be the face of A.I. solutions, NVIDA is looking like they’ll be the company providing the hardware to run them. As the old saying goes, during a gold rush you want to be the one selling the shovels.

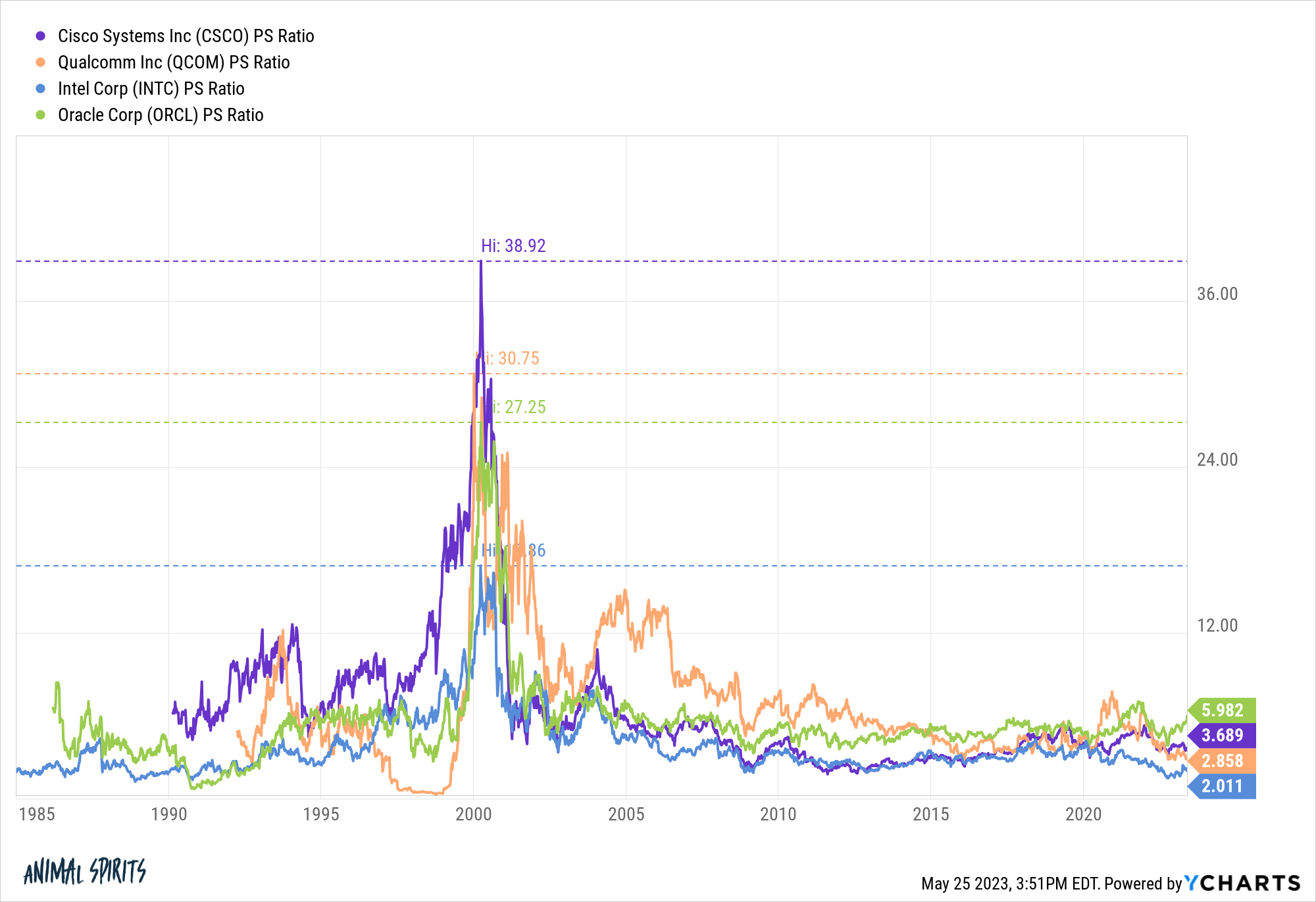

This has some in the investing world already thinking that NVDIA could be in a bubble already. Using the price-to-sales valuation metric, NVDIA trades at over 35x sales. This is at the level of a few of the famous dotcom companies before they burst in 2000.

Is An A.I. Stock Market Bubble Inevitable?

This is likely going to be the investing story of the near future. Stay tuned.