With the Democratic and Republican conventions wrapping up, the news has begun to shift away from the Coronavirus to the upcoming election. We’ve reached the season where analysts start predicting the potenital outcome and how it might impact your portfolio.

Get Ready for the Biden Stock Boom

Stock Investors Worry About a Biden Presidency

8 Presidential Election Stocks to Buy in Case Trump Wins Again

So that begs the question, does the stock market care which party wins the election and if so, what should you do?

Forecasting politics, like the short-term direction of the stock market, is difficult

We’re not that far removed from 2016 when virtually every analyst and media outlet predicted a Hillary Clinton win. We know how those predictions turned out. Even though the data may strongly point to one outcome, there are just too many variables at play to make political predictions with anything close to 100% certainty. If you’re trying to not only predict the outcome of the election, then forecast how that might impact the direction of the stock market, you have your work cut out for you.

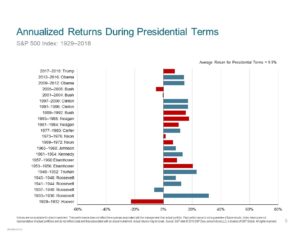

Even if you could predict the winner, does history point to one party being better for stock prices than another?

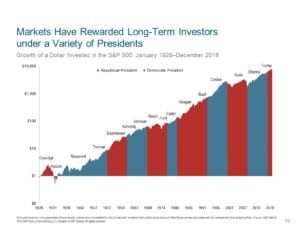

Just because it is difficult to predict the outcome doesn’t mean that traders won’t try to make short term bets on what they might expect from an incoming cabinet and potential policy. After all, the president of the United States is the single most powerful person in the world and can impact the playing field that US companies operate on. Presidents can also change the overall economic landscape (see the Republican tax cuts for corporations and the ongoing trade war with China). But be careful placing too much emphasis on what a president may or may not do for stock performance because over the long term it doesn’t matter nearly as much regardless of their political party.

Can you see pattern or correlation between the performance of the stock market and the president in the White House in the chart below?

Source – DFA

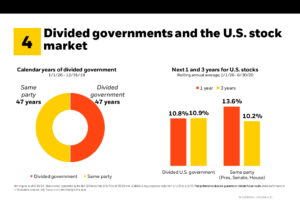

Some might conclude that it is not the party in the White House that matters, it’s the party in control of the White House and both houses of Congress that really drives policy. Here are the 1- and 3-year post-election returns for both scenarios:

Source – Blackrock

As I said in a post last year, presidents get too much credit for economic and stock market growth and too much blame for their contractions. It’s too neat of a comparison to draw a direct connection between who is in the White House and their ability to have a direct impact on the market. Too many other things have an impact on stock prices. Interest rates. Pandemics. Technological advances. It’s just not that simple.

Investors are asking themselves the wrong question

I believe the question is not,”What should I do to my portfolio in case _____wins”, it should be,”How can I take advantage of the current and future opportunities in the market regardless of who is in power?”.

Source – DFA

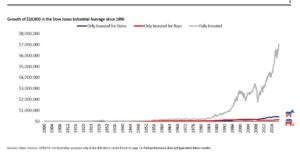

Do not let politics drive your investment decisions

Source – Invesco

So, what should you do?

Control what you can control and look to maximize the opportunities that are presented. Right now, you should be looking toward your tax and estate planning situation. Regardless of who takes control of the White House and Congress, higher taxes are probably on the horizon. The response to COVID has many states looking to raise revenues after running huge deficits this year. The Tax Cuts and Jobs Act is set to sunset at the end of 2025 and may be changed or accelerated if Democrats take power. Like all financial planning projections, it is helpful to look at your potential tax bracket and family dynamic not only today, but years from now. All signs are pointing toward the potential for higher taxes down the road. Here are 3 areas to consider:

Roth IRA conversions

For retirement savers with Traditional 401(k) and IRA accounts, you will be making taxable withdrawals from those accounts when you start to live on your portfolio – whether need to or not. You can lock in today’s tax rates by converting a portion of those accounts to a Roth IRA and paying the taxes now. You exchange a tax-bill today at potentially lower rates for tax-free growth for the rest of your life in a Roth IRA.

Roth IRA’s are also great estate planning tools as child beneficiaries inherit Roth IRA’s tax-free. Some of you might have forgotten about the SECURE act that was signed into law last year. The SECURE act essentially eliminated the “stretch IRA”, or the ability of IRA beneficiaries to spread the required distributions over their lifetimes. The new laws now require those beneficiaries to distribute the entire IRA in 10 years. Your adult children with thank you as traditional IRA and 401(k) beneficiaries take those required distributions as taxable income which can occur during their prime earning years.

Look to take capital gains and accelerate taxable income this year

Year-end capital gains planning is probably something that most investors are engaged in. Usually that process involves trying to match investment gains with losses to reduce your overall tax bill. This year, you may want to consider pulling those gains into this tax year. Part of the proposed Biden tax plan is to raise the long-term capital gains rate from either 0-20% up to your taxable income rate (both calculated based on your adjusted gross income). If you are sitting on long-term gains from appreciated positions you’re looking to diversify from (I’m looking at you Tesla shareholders), you may want to do that this year.

Speaking of pulling income into this year – the CARES Act that was enacted for COVID relief allowed those taking required distributions from retirement accounts to skip 2020 and resume the distributions next year. Those that know they may have goals or expenses to fund soon above and beyond their 2021 RMD may want to take a distribution this year anyway to lock in your 2020 tax rate.

Get ready to review your estate plan

Lastly, expect to hear about changes to estate planning laws if Biden is elected. There is some momentum behind changing the amount of money that can be passed tax-free to heirs, currently $11.58 million, down to a lower level. There is also talk about eliminating the step-up in cost basis which would apply capital gains tax to assets at death instead of getting the fair market value of that asset. Estate planning attorneys may be in for a busy 2021.

Need to discuss any of the above? Schedule some time on my calendar here.